Budi Rachman

IFRS Practice Lead

https://www.linkedin.com/pulse/hamilton-engine-makes-ifrs-16-compliance-simple-budi-rachman

What is IFRS 16?

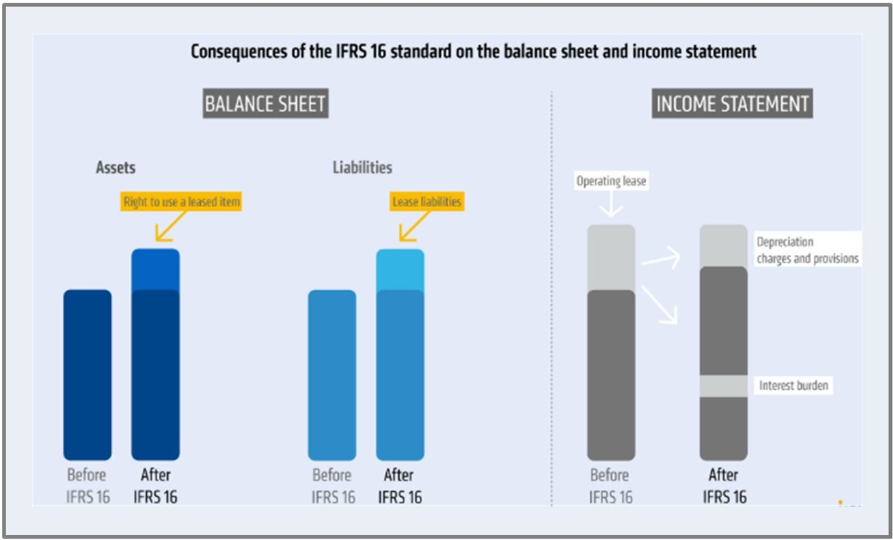

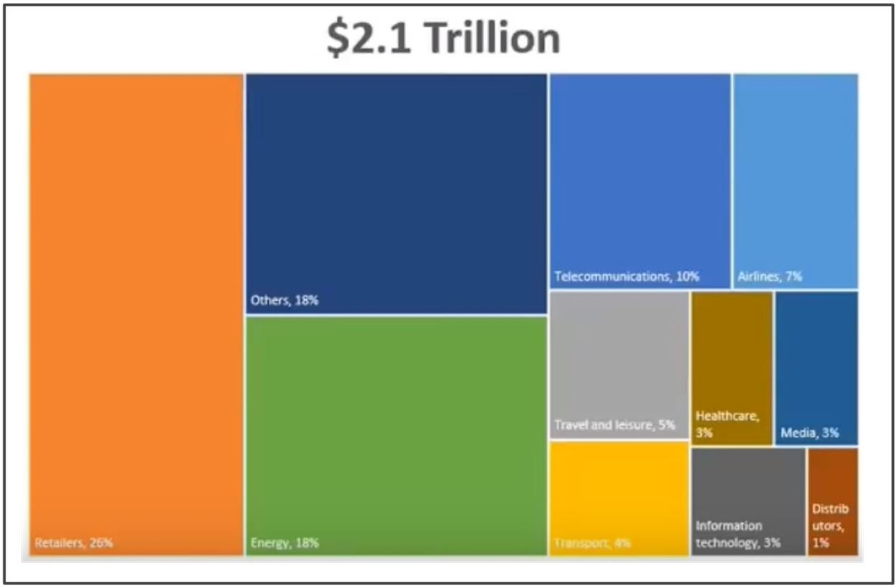

It is a new lease accounting standard that will impact many businesses worldwide, which will be effective date on 1st January 2019. Under the new standard, if the lease contract is for a year or more, companies will recognise new assets (right-of-use assets) and liabilities (lease liabilities), bringing added transparency to the balance sheet, which is estimated over 2 trillion dollars of leased assets will be added to the balance sheet.

Some industries get affected more than others, in particular:

- Retail

- Telecommunications

- Oil and Gas

- Airlines

Are you ready to deal with the IFRS 16 new leasing standard?

Here are some guidance to adopt IFRS 16 for your organization:

1. Understand the new accounting standard

2. Gather information about current process and policies

3. Evaluate impact to the current process and system

4. Select transition approach, follow the best practice for your industry, majority of companies have opted modified retrospective approach.

5. Select and design the right solution that easy to implement and minimize the impact to the organization

6. Implement and monitor for gradual improvements

Is Hamilton engine Lease Accounting the right solution?

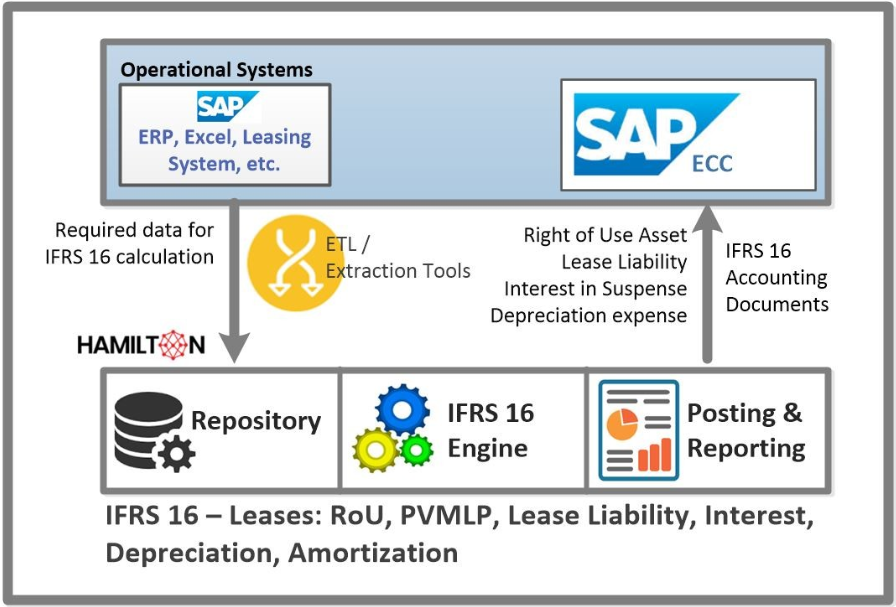

Yes, it is! Hamilton engine is the simplest, fastest, cost effective and the most comprehensive solution for businesses to achieve IFRS 16 compliance in an ever-evolving world of accounting regulations. It can be implemented less than 3 months without any major impact to the organization.

Hamilton engine is the only solution in the market that has built-in functionality that solves both the IFRS 15/ASC 606 and IFRS 16/ASC 842 regulatory needs. And moreover, Hamilton engine’s framework (The Automated Accounting Framework) is designed to adapt to future requirements as well and it can be used to fulfil for specific business needs to gain some competitive advantages.

Hamilton engine is embedded and integrated with SAP

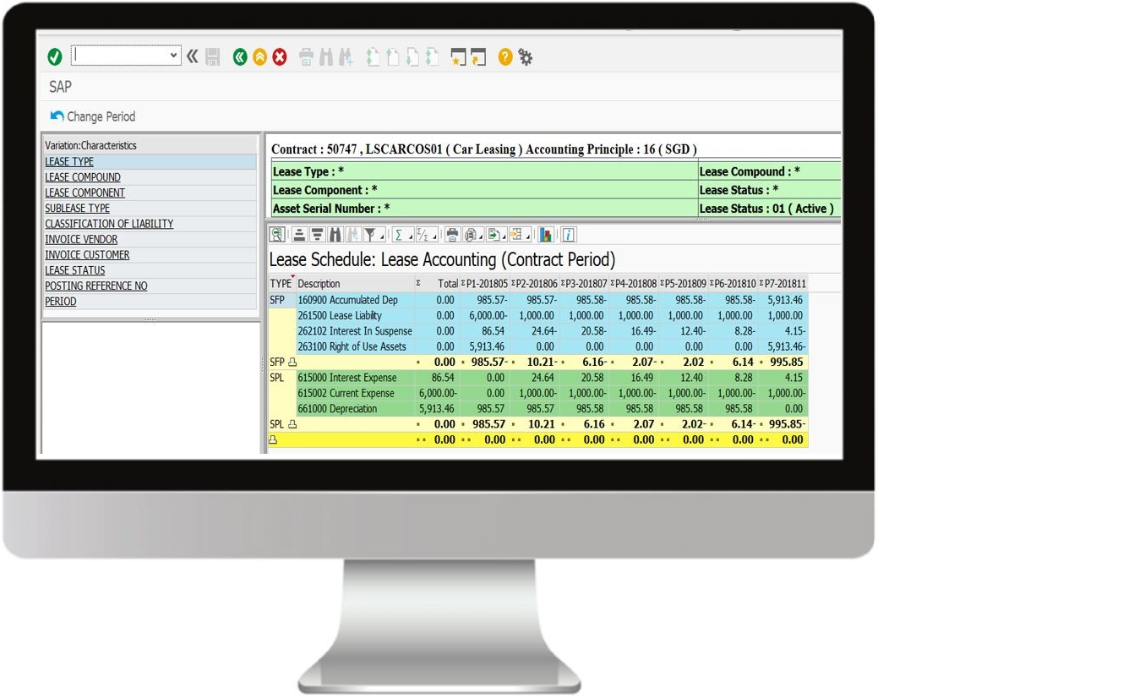

Hamilton engine Lease Accounting Schedule

Here are some features of Hamilton engine:

- PVMLP (Present Value Minimum Lease Payment) with configurable compounding interval

- Auto-separating Lease and Non-Lease Components

- Multiple options of payment cycle: In advance, In arrears, Ad-hoc.

- Dynamic condition types to support Initial Direct Cost, renewal option, purchase option, residual value, estimated penalty for early termination.

- Flexible discount rate determination

- Auto determination of low value asset and short-term lease

- Auto determination of classification (operating lease or finance lease) for ASC 842.

- Lease modification and re-measurement: Increase/Decrease of scope of ROU asset

- Lease early termination with and without notice period

- Consumer price index – auto revaluation

- Parallel currency

- Parallel ledger

- Support ASC 842 with straight line expense method

- Sublease

- Intercompany lease

- Backdated of lease contract inception and modification

- Support both transition methods: full retrospective and modified retrospective

- Support non-calendar period

- Dynamic G/L account determination

- Projection of Lease Balance Sheet and Profit/Loss Statement

- Financial Position Movement to disclose all lease events.

- Slice/Dice Lease Reporting and Disclosures

- Integrated with SAP FICO, SD and MM modules

In the next articles, I will explain with some illustrative use cases on how Hamilton engine helps the organization to implement IFRS 16 with ease, and transitioned to the new standard smoother, as painless as possible. If you want to know more about Hamilton engine, you can visit www.hamiltonpi.co.id

Leave a Reply